Investing in a foreign market like Brazil can be a lucrative endeavor, but it also requires a meticulous approach to risk management. With a history of economic turbulence and frequent political changes, Brazil presents both opportunities and pitfalls for investors. Moreover, the intricacies of its regulatory environment can prove daunting to those unfamiliar with its nuances. Whether you are a seasoned investor or considering your first foray into Brazil, this article equips you with the knowledge needed to thrive in this dynamic landscape.

Risk Identification and Assessment

When considering investments in Brazil, or any foreign market for that matter, a crucial first step is conducting a comprehensive risk assessment. This assessment helps you understand the unique challenges and potential pitfalls associated with your investment. Here, we’ll explore two critical aspects of risk assessment: political and economic risk analysis, as well as legal and regulatory risk assessment.

Political Risk Analysis

Political stability plays a pivotal role in investment success. In Brazil, political dynamics can be fluid, and elections, changes in government, and policy shifts can impact your investments. To assess political risk, stay informed about local politics, understand the current political climate, and evaluate the potential impact of political events on your investments. Engaging with local experts and monitoring reputable news sources are essential steps in this process.

Economic Risk Analysis

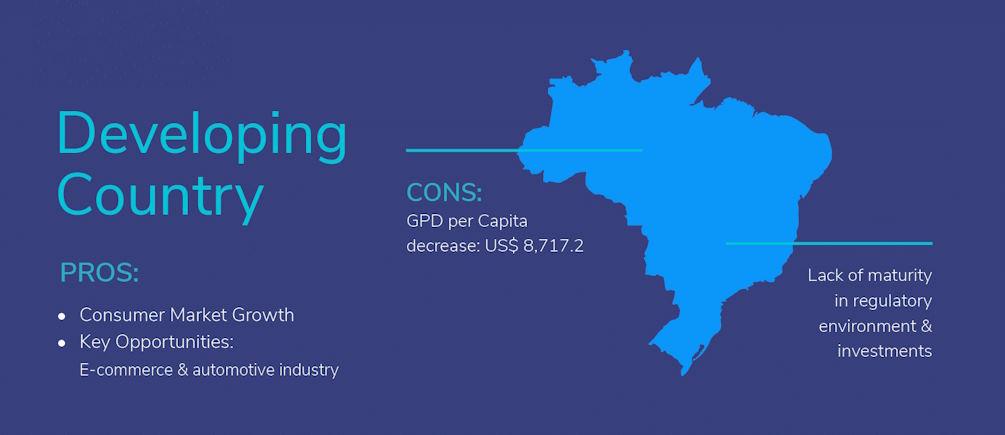

Economic factors, including inflation rates, GDP growth, and fiscal policies, significantly influence investment outcomes. Conduct a thorough economic risk analysis by examining these factors. Look for trends and potential threats to economic stability. Understanding how economic changes may affect your investments is crucial for informed decision-making.

Legal and Regulatory Risk Assessment

Navigating Brazil’s legal and regulatory landscape can be complex. Different sectors may have varying rules and requirements. Engage legal experts with expertise in Brazilian law to guide you through this process. Ensure compliance with local regulations and consider how changes in laws or regulations could impact your investments.

Currency Risk Evaluation

Send money to Brazil involves accounting for currency risk as a critical factor. Fluctuations in exchange rates can exert a substantial impact on your investment returns. To address this currency risk, it’s essential to gain insight into how exchange rates vary and to explore hedging strategies. Leveraging financial instruments like currency futures or options can also be valuable in safeguarding your investments against unfavorable currency movements.

Diversification Strategies

Diversification is a cornerstone of sound investment practice, and it holds particular significance when considering investments in Brazil. This vast and diverse nation offers a myriad of opportunities, but it also carries unique risks. In this section, we’ll delve into the importance of diversification, explore various asset classes, and discuss geographical diversification within Brazil.

Importance of Portfolio Diversification

Diversification is like the safety net of your investment portfolio. It spreads risk across various assets, reducing the impact of poor performance in one area. In the Brazilian context, diversification can help shield your investments from the volatility associated with specific industries or regions. A diversified portfolio can enhance long-term stability while potentially increasing overall returns.

Selecting a Mix of Asset Classes

- Equities: Brazilian equities offer opportunities for growth, but they can also be volatile. Balance the risks by combining different types of stocks, including those in established industries and emerging sectors.

- Fixed Income Securities: Bonds and other fixed income instruments can provide stability to your portfolio. Brazilian government bonds (Treasury bonds) and corporate bonds offer options for income-focused investors.

- Alternative Investments: Consider alternative investments like real estate, private equity, or hedge funds. These can offer diversification benefits not correlated with traditional asset classes.

Geographical Diversification within Brazil

- Regional Investment Considerations: Brazil is a vast country with regional variations in economic activity. Diversify your investments by considering different regions, such as the industrialized south, resource-rich north, or the booming urban centers in the southeast.

- Urban vs. Rural Investment Opportunities: Assess whether urban or rural investments align better with your risk tolerance and objectives. Urban areas may offer more liquidity and established markets, while rural investments, like agriculture, can provide diversification and potentially lucrative opportunities.